This is a game-changer for married couples residing in Kentucky with assets with significant capital gains. As a certified financial planner, I’m always looking for strategies to help my clients optimize their financial futures. Today, I’m excited to share a powerful tool for married couples in Kentucky: the Community Property Trust Act. This legislative change, which went into effect in July 2020, offers an incredible opportunity for estate planning and potential tax savings.

“Community Property” is a specific designation for the ownership of assets by married couples. It implies that all assets are owned mutually by both spouses. Only a few states currently utilize community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Wisconsin, Washington, and Wisconsin. However, in 2020, the State of Kentucky adopted an optional community property system under the rules of the 1944 U.S. Supreme Court ruling known as the Harmon Decision.

What is a Kentucky Community Property Trust?

A Kentucky Community Property Trust (CPT) is a particular type of trust that allows married couples to convert their separate property into community property. This might sound like a slight legal distinction, but it can significantly affect estate planning and taxes.

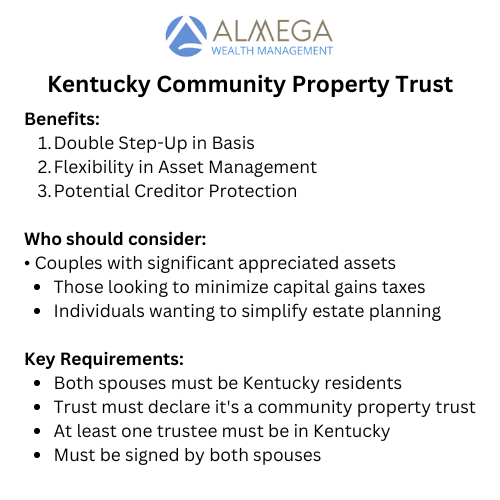

The Benefits of Kentucky’s Community Property Trust

1. Double Step-Up in Basis

The most notable advantage of a Kentucky Community Property Trust is the potential for a full step-up in basis on all assets in the trust when the first spouse passes away. This is a game-changer for capital gains tax planning.

Here’s how it works:

- When an asset appreciates in value, the difference between its original cost (basis) and its current value is subject to capital gains tax when sold.

- In non-community property states (like Kentucky), only the deceased spouse’s half of jointly owned property receives a step-up in basis at death.

- With a CPT, both halves of the property receive a step-up in basis to the fair market value at the date of death.

This double step-up can potentially save surviving spouses and/or their heirs thousands of dollars in capital gains taxes when they eventually sell the assets.

2. Flexibility in Asset Management

Unlike some other estate planning tools, a Kentucky Community Property Trust offers flexibility in asset management. Both spouses can act as trustees, allowing them to maintain control over the assets during their lifetimes.

3. Creditor Protection

A downside to the CPT is that it exposes both halves of the assets to creditors. While this can be seen as a disadvantage, those couples without significant debt will not necessarily consider this an issue. Furthermore, an excellent financial planner will review their client’s liability exposure and recommend an umbrella insurance policy to offset the increased exposure should something like an at-fault automobile accident occur.

Who Should Consider a Kentucky Community Property Trust?

A Community Property Trust can be particularly beneficial for:

- Kentucky residents

- Couples with significant appreciated assets

- Those looking to minimize capital gains taxes for their surviving spouse and heirs

- Individuals wanting to simplify their estate planning

Setting Up a Kentucky Community Property Trust

While the benefits are clear, setting up a Kentucky Community Property Trust requires careful consideration and expert guidance. Here are some key points to keep in mind:

- Both spouses must be Kentucky residents when the trust is created.

- The trust must expressly declare that it is a community property trust under Kentucky law.

- At least one trustee must be a Kentucky resident, or a bank or trust company authorized to act as a trustee in Kentucky.

- The trust must be signed by both spouses.

Conclusion: A Powerful Tool for Financial Planning

The Kentucky Community Property Trust Act represents a significant opportunity for married couples to optimize their estate planning and potentially save on taxes. As with any financial strategy, consulting with qualified professionals – including a CERTIFIED FINANCIAL PLANNER™️ and an Estate Planning Attorney – is crucial to determine if a Community Property Trust is right for your specific situation.

By staying informed about tools like the Kentucky Community Property Trust, you can make more informed decisions about your financial future and leave a lasting legacy for your loved ones.

Remember, effective financial planning is about more than just accumulating wealth – it’s about protecting and optimizing that wealth for future generations. The Kentucky Community Property Trust could be a key part of your comprehensive financial strategy.

Bryan Wisda is a CERTIFIED FINANCIAL PLANNER™️ and a NAPFA-registered financial Advisor. He is the President of Almega Wealth Management, a boutique wealth management firm that provides successful families with investment consulting, advanced planning, and relationship management services from its offices in Arizona, Kentucky, and North Carolina. Bryan has over 31 years of experience working in the financial services industry; he is most known for helping successful families create a life beyond wealth.