In the world of investments, few tools are as powerful—and often misunderstood—as the tax code. One such provision, the “wash sale rule,” governs how losses on investments are treated for tax purposes. However, when it comes to cryptocurrency, there is a unique (and potentially fleeting) opportunity to leverage the tax-loss harvesting opportunity in crypto assets due to the absence of this rule for tax efficiency. As a CERTIFIED FINANCIAL PLANNER™️, I see this as a moment for investors to embrace intentional strategies that optimize their portfolios and reduce tax burdens.

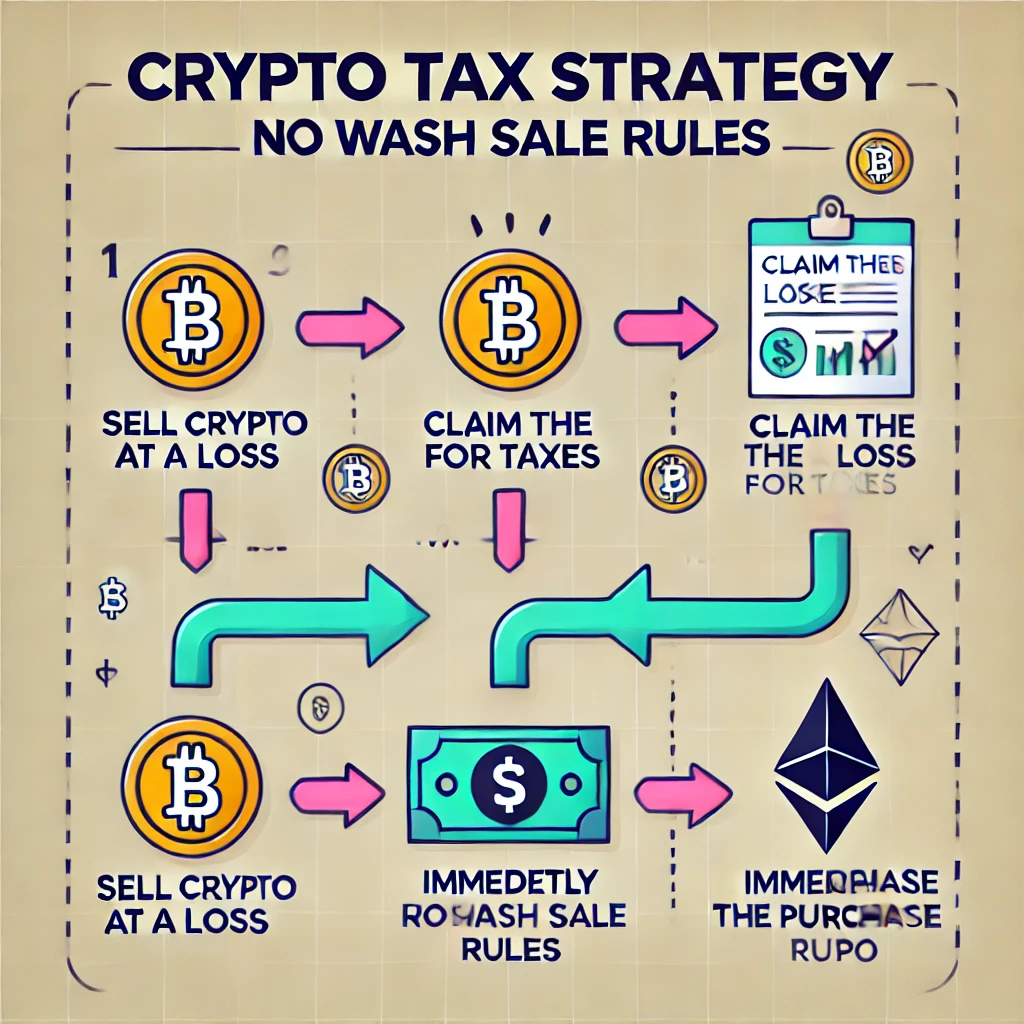

Here’s the insight: crypto assets are not subject to the wash sale rules that apply to stocks, bonds, and other securities. The IRS classifies cryptocurrency as property, not securities. This classification creates a loophole in which you can harvest tax losses without being restricted by the typical 30-day waiting period that accompanies a wash sale.

What Is the Wash Sale Rule?

First, let’s define the wash sale rule. For most securities, if you sell an investment at a loss and repurchase a substantially identical investment within 30 days (before or after the sale), the IRS disallows the loss for tax purposes. The rule exists to prevent investors from gaming the system by selling an investment merely to lock in tax benefits while maintaining their market position.

Cryptocurrencies, on the other hand, are not bound by this rule. Since the IRS treats crypto assets as property, you can sell a crypto asset to realize a loss, then immediately repurchase it—seconds later, if you wish—while still claiming the loss on your tax return.

This creates a rare tax planning opportunity that’s as fleeting as a sunset, given the growing calls for Congress to close this loophole.

The Strategic Advantage of Crypto Tax-Loss Harvesting

Crypto markets are known for their volatility, and while this may be unsettling, it also creates a consistent tax-loss harvesting opportunity in crypto assets. Imagine this scenario:

- You purchased a cryptocurrency for $50,000, but the value has since dropped to $30,000.

- You sell the cryptocurrency, locking in a $20,000 capital loss.

- Moments later, you repurchase the same cryptocurrency at the current market price of $30,000.

You’ve now realized a $20,000 loss that can offset capital gains elsewhere in your portfolio—or up to $3,000 of ordinary income annually if you don’t have gains to offset. Meanwhile, you remain fully invested in your crypto asset without interruption.

It’s like hitting the “undo” button on your portfolio loss while keeping the tax benefit intact.

Why Act Now?

This unique tax strategy may not be around forever. Lawmakers are increasingly aware of the gap in tax-loss harvesting opportunity in crypto assets versus traditional investment assets, and proposals to subject crypto to wash sale rules have been floated. Waiting too long to take advantage of this strategy could mean missing out entirely.

The Fine Print

While this opportunity is compelling, it’s essential to keep the following considerations in mind:

- Tracking Basis and Trades: Frequent buying and selling can create complex record-keeping challenges. Make sure you have a reliable system or software for tracking your cost basis and transactions.

- State Tax Implications: Not all states follow federal tax treatment precisely. Consult a tax professional to understand how your state handles crypto losses.

- Future Gains: Keep in mind that repurchasing crypto at a lower price means your new cost basis is also lower. When you eventually sell the asset at a gain, that gain will be larger than it otherwise would have been.

- Consult a Professional: As with any tax strategy, the devil is in the details. Work with your financial planner or tax advisor to ensure your approach aligns with your overall financial goals.

Seize the Opportunity

Cryptocurrency presents a tax planning opportunity that is as dynamic as the asset itself. By intentionally harvesting losses in crypto, you can not only reduce your current tax liability but also position your portfolio for a more efficient future.

Time, however, is of the essence. Like all good things in the tax code, this loophole is unlikely to last forever. If you’ve been sitting on unrealized losses in crypto, now may be the time to act. Think of it as catching the crypto train before the wash sale rule closes the tracks.

Please note, this strategy more than likely does not apply to crypto ETFs or mutual funds, only the actual crypto asset.

As always, Almega Wealth Management is here to help you navigate this complex terrain. Let’s schedule a time to review your financial plan and ensure you maximize every opportunity available to you. Click here to schedule an exploratory call with us.

Bryan Wisda is the President of Alemga Wealth Management. He is a CERTIFIED FINANCIAL PLANNER™️ and NAPFA-Registered Financial Advisor. He is most known for helping successful families create a life beyond wealth and believes everyone deserves a financial advisor who will emerge as a bolder leader for their family.