Almega Wealth Management is a Fee-Only Registered Investment Advisor, but what does it mean to be Fee-Only?

There are three basic ways in which financial advisors are compensated:

1. Commission-based model

2. Commission and fee model

3. Fee-Only model

A commission based model means that the financial advisor you work with will receive a commission every time you buy and sell an investment. This is the business model that most financial advisors operated under up until the early 2000s. With a commission-based model if you bought shares in a stock or mutual fund your financial advisor received a commission. This creates a conflict of interest as the client never knows if their financial advisor is motivated by the amount of the commission involved. Most often, under this model, the client will never know exactly how much commission is being paid to the financial advisor.

In the early 2000s most financial advisors switched from a commission-based model to a commission and fee model. With this model the financial advisor typically charges a fee for the traditional investments (stocks and mutual funds) they manage for their clients but also have the ability to earn a commission for the sale of annuities, IPOs, secondary offerings, and non-traditional investments like hedge funds and private equity placements. Any financial advisor who works for a large Wall Street brokerage firm works under this model.

Most Registered Investment Advisors typically use the commission and fee-model so they may receive compensation for the sale of annuities and life insurance products.

Only a very small percentage of Registered Investment Advisors, like Almega Wealth Management, utilize the Fee-Only model of compensation. With the fee-only model, the financial advisor derives all their compensation only from the fees paid directly to them by their clients for the management of their investments and financial planning engagement. Those financial advisors who utilize a fee-only model of compensation are true fiduciaries for their clients as their advice to their clients is the least clouded by compensation models.

Our position is that the Fee-Only model is the most transparent model in which a client can work with a financial advisor and as such this is the model we choose to use in our firm.

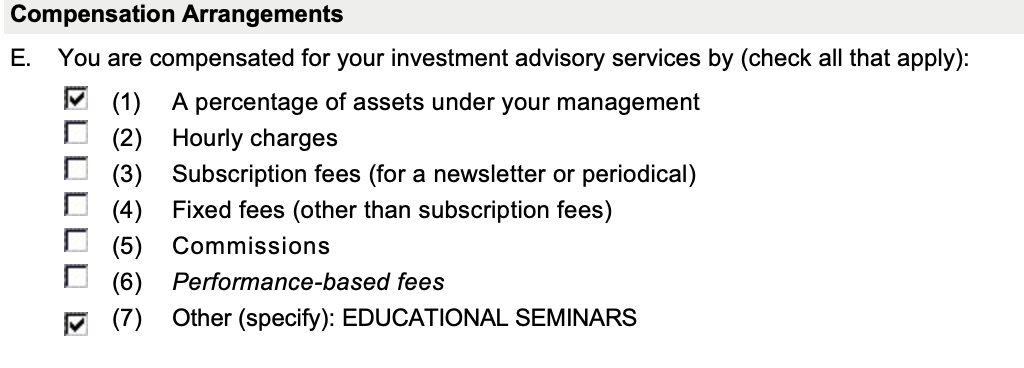

So, how do you know if your financial advisor utilizes a fee-only model of compensation? The best way to find out is to do the research yourself by looking up your financial advisor’s firm on the SEC website. To do this, visit adviserinfo.sec.gov and look up your financial advisor’s firm. Then click on the link View Latest Form ADV Filed and scroll down to Item 5, Section E which will look like this:

If you see that the box for commissions is checked this means your financial advisor is NOT a fee-only advisor. Additionally, if the firm your financial advisor works for does not have a listing on the SEC website this also means they are not a fee-only advisor.

Most financial advisors who are fee-only will have the first box checked which shows they are paid a fee based on the value of your investments with them. Some firms may charge hourly fees and/or fixed fees. Typically, hourly charges and fixed fees are used by firms who are providing only financial planning advice and do little in the way of managing investments. Performance-based fees is the typical compensation for registered investment advisors who manage alternative investments, private equity, and hedge funds.

Some registered investment advisors go to great lengths to conceal the fact that they receive commissions. One way they do this is through common ownership of another firm that receives commissions like an insurance agency. If this is the case you’ll have to read deeper into the Form ADV Part 1 and Part 2A to discover this. We always suggest reading your financial advisor’s Form ADV Part 2A as this goes into great detail about the business practices of your financial advisor’s firm. If you ask, your financial advisor should always give you a copy of their firm’s Form ADV Part 2A. If you would like a copy of Almega Wealth Management’s Form ADV Part 2A please send us a message using our Contact page.

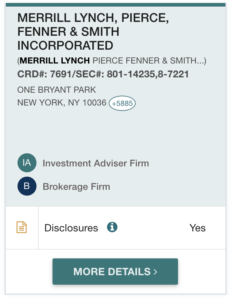

Additionally, if the listing for your advisor shows they are both an Investment Advisor Firm and a Brokerage Firm such as this entry for Merrill Lynch this also means your financial advisor is not a fee-only advisor.

The position of Almega Wealth Management is that the fee-only model of compensation is the most transparent model of compensation in which a financial advisor works with individual clients and as such this is the model we have chosen for our firm.